BTC Price Prediction: Breaking $116K Resistance Could Trigger Next Leg Up

#BTC

- Technical indicators show BTC trading above key moving averages with bullish momentum

- Macroeconomic factors including Fed policy and inflation data support upward movement

- Institutional adoption through ETFs and whale activity indicates strong fundamental demand

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Averages

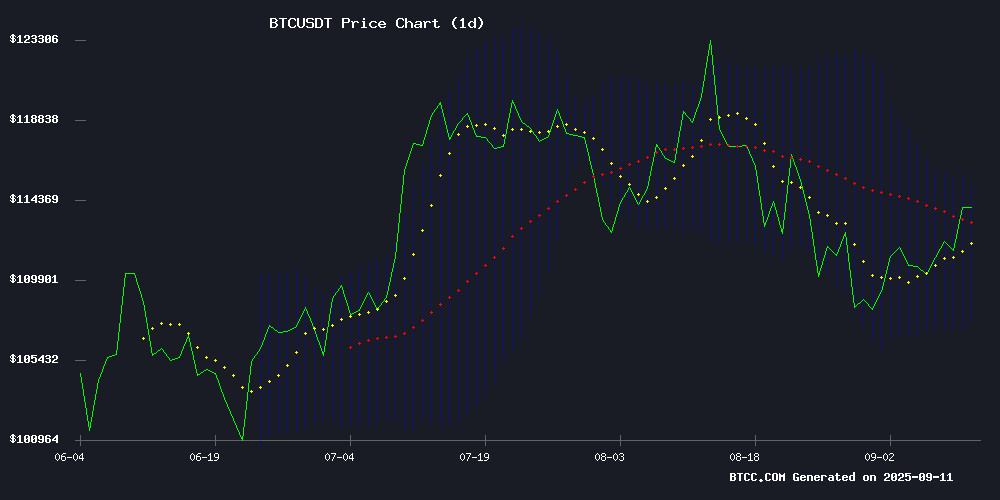

According to BTCC financial analyst Robert, Bitcoin's current price of $114,407 sits comfortably above its 20-day moving average of $111,347, indicating sustained bullish momentum. The MACD reading of -1231.08 suggests some near-term consolidation, but the position above the middle Bollinger Band at $111,347 maintains an overall positive technical outlook. Robert notes that holding above the $111,347 level could pave the way for a test of the upper Bollinger Band resistance at $115,167.

Market Sentiment: Fed Policy and Institutional Demand Drive Optimism

BTCC financial analyst Robert highlights that current news flow strongly supports the technical bullish case. The anticipation of Fed rate cuts, combined with Bitcoin ETF inflows and record-high hashrate despite miner challenges, creates a fundamentally strong environment. Robert emphasizes that cooling inflation signals and sustained institutional interest, as evidenced by the 13-year dormant whale movement, provide additional confidence in Bitcoin's upward trajectory.

Factors Influencing BTC's Price

Bitcoin ETFs Poised for Influx as Fed Rate Cut Looms

U.S. spot Bitcoin ETFs recorded over $1 billion in net inflows last week as Bitcoin held firm above $110,000. The stage is set for a potential demand shock if the Federal Reserve proceeds with an expected 25 basis point rate cut on September 17. Fidelity's FBTC and BlackRock's IBIT led the charge with $299 million and $211.2 million inflows respectively, according to Farside Investors data.

At current prices near $114,000, the $757 million daily inflow equates to 6,640 BTC purchased - absorbing nearly 15 days of post-halving supply. The April halving reduced daily issuance to approximately 450 BTC, creating a structural supply squeeze that amplifies price sensitivity to institutional demand.

Reuters reports Bitcoin traded at $114,132 on September 11, still below August's record high above $124,000. The arithmetic remains compelling: monthly inflows of $5 billion would soak up 97.5 days of mined supply, potentially creating explosive upside pressure in a rate-cut environment.

Bitcoin’s Growth Explodes: Will $116K Resistance Trigger Further Gains?

Bitcoin continues its upward trajectory, buoyed by robust demand from both retail and institutional investors. Trading volume spiked 16.53% to $55.23 billion, underscoring heightened market activity and confidence.

Analysts identify $116,000 as a critical resistance level, with $113,000 serving as key support. The cryptocurrency currently trades at $114,070, up 1.84% over 24 hours and 3.25% weekly.

Market observers suggest breaching the $116,000 threshold could signal further upside potential. "Bitcoin is recovering after testing support," notes CryptoVIPsignal, highlighting the regained bullish momentum.

Arkham Reveals the World’s Biggest Crypto Whales in 2025

Arkham Intelligence has identified the largest cryptocurrency holders, with Binance leading the pack at $209 billion in assets. Coinbase follows closely with $155 billion, while Bitcoin's enigmatic creator Satoshi Nakamoto ranks third with $125 billion in BTC holdings.

Institutional giants BlackRock and Fidelity have cemented their positions in the top 10, holding $100 billion and $47.5 billion respectively. MicroStrategy's aggressive BTC accumulation strategy has ballooned its treasury to $53 billion, outperforming many traditional financial players.

The analysis groups wallets by entity, revealing concentrated control of approximately $1.6 trillion in digital assets across exchanges, protocols, and early adopters. This consolidation of wealth underscores crypto's maturation from niche asset to institutional darling.

Bitcoin Surges Past $114,000 Amid Cooling US Inflation Signals

Bitcoin breached the $114,000 threshold following a softer-than-anticipated US Producer Price Index (PPI) report, fueling speculation of an impending Federal Reserve rate cut. The PPI decelerated to 2.6% year-over-year, undershooting the 3.3% consensus forecast. This development has invigorated traders, who interpret it as a precursor to looser monetary policy—a tailwind for risk assets like cryptocurrencies.

Market analysts highlight the historical lag between producer and consumer inflation, suggesting the PPI downturn may foreshadow a similar trend in the Consumer Price Index (CPI). While hedge funds remain cautious pending CPI confirmation, the broader trajectory points to disinflationary momentum heading into Q4. Bitcoin has historically exhibited volatility during Fed pivot cycles before resuming its upward climb, with on-chain metrics like Market Value to Realized Value (MVRV) signaling accumulation phases.

U.S. Stocks Climb Despite Hotter-Than-Expected CPI Data, Bitcoin Rides Bullish Sentiment

The Dow Jones Industrial Average rose more than 170 points on Thursday, defying expectations as August's consumer price index data came in hotter than forecast. The S&P 500 gained 0.3%, while the Nasdaq Composite also edged higher, maintaining record highs. Treasury yields dipped, with the 10-year note falling to 4.002%.

Investors shrugged off the inflation print, betting on an imminent Federal Reserve rate cut. Risk assets broadly benefited from the optimistic market mood—Bitcoin traded higher amid the rally. The cryptocurrency's upward trajectory aligns with equities as capital flows into speculative markets.

Market participants appear to be pricing in a dovish Fed pivot despite sticky inflation. The blue-chip index's rally follows muted sessions earlier this week, suggesting renewed appetite for equities. Treasury markets echoed the risk-on shift, with long-dated bonds seeing modest demand.

Bitcoin Holds Steady Near $114K Amid Rising US Inflation

Bitcoin maintained its position near $114,000 as August inflation data revealed a 2.9% annual increase, up from July's 0.2% rise. The hotter-than-expected CPI print briefly dampened expectations for aggressive Federal Reserve rate cuts, with odds of a 50 basis point reduction slipping from 12% to 9%.

Market analysts anticipate minimal sustained volatility ahead of next week's FOMC meeting, noting Bitcoin's resilience despite macroeconomic headwinds. BTC ETF flows meanwhile hit an eight-week high, underscoring continued institutional interest.

The Bureau of Labor Statistics report indicates persistent inflationary pressures, with the 2.9% reading drifting further from the Fed's 2% target. While a September rate cut remains likely, traders now price in greater probability of a modest 25 basis point adjustment.

Kraken Launches Simplified Perpetual Contracts for Crypto Trading

Kraken has introduced "Kraken Perps," a new derivatives product designed to simplify perpetual contracts for cryptocurrency trading. These instruments allow users to speculate on price movements without owning the underlying assets, offering flexibility with no expiry dates or lock-in periods.

The contracts, currently available in select regions, use USD as collateral, with plans to support additional assets. Traders can take long or short positions based on their market outlook, mirroring traditional derivatives but with perpetual flexibility.

Kraken's move aligns with growing demand for accessible crypto derivatives, though risks remain inherent in leveraged trading. The exchange emphasizes user control over position sizing and exit timing, framing it as a more dynamic alternative to static bets.

U.S. CPI Rises Faster Than Expected in August, Bitcoin Slips Slightly

U.S. inflation accelerated more than anticipated in August, with the Consumer Price Index (CPI) climbing 0.4% month-over-month, surpassing forecasts of 0.3%. Year-over-year CPI increased by 2.9%, matching expectations but rising from July's 2.7%. Core CPI, excluding volatile food and energy prices, rose 0.3% monthly and 3.1% annually, both in line with projections.

Bitcoin dipped approximately 0.5% following the data release, sliding from $114,300 to $113,700. The broader market reaction was muted: U.S. stock index futures held modest gains, Treasury yields edged lower, and gold pared losses. A simultaneous surge in weekly jobless claims to 263,000—far worse than expected—added complexity to the Federal Reserve's policy calculus as it balances softening employment against persistent inflation.

DC Sues Athena Bitcoin Over Scam-Linked Crypto ATM Deposits

The District of Columbia's Attorney General has filed a lawsuit against Athena Bitcoin, a major crypto ATM operator controlling 13% of U.S. crypto ATMs. The legal action alleges the company knowingly facilitated scams through its kiosks, with 93% of deposits linked to fraudulent activity.

Elderly residents appear to be primary targets, with a median victim age of 71 and average losses nearing $8,000. In one extreme case, a resident lost $98,000. Fraudsters typically pose as tech support or financial advisors, directing victims to Athena's machines to transfer funds.

Attorney General Brian Schwalb characterizes Athena's compliance measures as woefully inadequate, creating what he calls an "unchecked pipeline for illicit international fraud transactions." Between May and September 2024 alone, the company allegedly processed hundreds of thousands in scam-derived deposits.

Bitcoin's Hashrate Hits Record High Despite Falling Miner Revenue

Bitcoin's computational power surged to an all-time high of 1,027 exahashes per second this week, underscoring the network's resilience even as miner profitability faces pressure. The milestone reflects both increased participation and improved hardware efficiency in the mining sector.

While the hashrate achievement demonstrates Bitcoin's robust network security, miners confront a paradox. Hashprice - revenue per terahash - has declined nearly 8.4% despite the network's growth. This squeeze comes as energy costs rise globally, forcing operators to adopt more efficient technologies to maintain margins.

The cryptocurrency's price stability above $100,000 continues to support mining activity. Market observers note the hashrate surge signals long-term confidence in Bitcoin's infrastructure, even as short-term economic challenges persist for miners.

13-Year Dormant Bitcoin Whale Moves $108.8M

A long-dormant Bitcoin whale has resurfaced, transferring 955 BTC ($108.8 million) after 13 years of inactivity. The movement included 137.03 BTC ($15.63 million), with 5 BTC sent to a Kraken deposit address. These coins were originally acquired when Bitcoin traded near $12, suggesting significant unrealized profits.

The sudden activity hints at potential profit-taking or portfolio rebalancing. Market participants are watching closely, as such large movements from early holders often precede short-term volatility. The transfers to exchanges could signal impending sell pressure, though the majority of funds remain in private wallets.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents a compelling investment opportunity. The combination of strong technical positioning above key moving averages, supportive macroeconomic factors including potential Fed rate cuts, and growing institutional adoption through ETFs creates a favorable environment. However, investors should be aware of near-term resistance around $116,000 and monitor inflation data closely.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | +2.75% above | Bullish |

| Bollinger Position | Upper band: $115,167 | Testing resistance |

| MACD | -1231.08 | Consolidation phase |

| Key Resistance | $116,000 | Critical breakout level |